The outbreak of COVID-19 has shaken the global economic situation and aggravated the downward trend of the global economy. In the post epidemic era, China's export pressure has soared with unstable international relations and fluctuant transport market. This month, the ship auction market in China has seen a total of 41 auctions and 19 transactions, with a transaction rate of 46.3%. The total starting price is about ¥147.39m, while the total transaction price is ¥160.06m. The data have declined from the previous month.

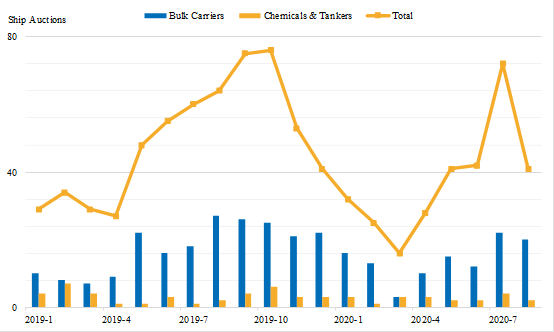

Affected by fluctuations in the transportation, the ship auction market tends to hold a wait-and-see attitude.China's export trade has been reduced sharply, and the "internal economic cycle" policy has accelerated. The transportation market has fluctuated sharply this month, but the future expectation of the market is uncertain and shipowners hold a strong wait-and-see mood. According to data from www.shipbid.net , the total ship auctions of August were 41,which decreased 31 MOM and 23 YOY. Among them, the bulk carrier auctions were 20, which decreased 2 MOM. The chemical & tanker auctions were 2, which also decreased 2 MOM. In terms of transaction rate, there were 19 auctions traded in August, which decreased 14 MOM, with a transaction rate of 46.3%, basically the same as last month.

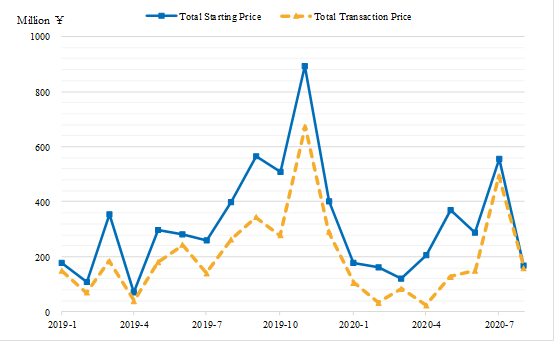

In August, the transaction price decreased by over 70% from the previous month. The total starting price of the Chinese ship auction market was approximately ¥147.39m, with a significant decrease of ¥409.87m MOM and decreased¥ 250.32m YOY. The total transaction price was ¥160.06m, which decreased ¥332.86m MOM and ¥103.20m YOY.

Chart1 Total of Ship Auctions in China

Chart2 Total Price of Ship Auction in China

The trends of various auction markets are different while the coastal bulk carrier market is good.At present, the global economic recovery is under great pressure. Affected by the COVID-19, deteriorating international relations, and US technology export restrictions, and the increasing pressure of China-US decoupling, China has issued a number of economic stimulus policies. The market has already been affected by the policy expectations, but the funds and supports brought about by the policies are still in the process, so the downstream demands haven’t been improved significantly. The transportation market fluctuates greatly by the sharp decline in exports, and uncertain future development of the market. Recently, the ship trades are mainly based on rigid demand.

In terms of judicial auction, there were 27 ships auctioned in August, of which 10 ships were sold, with the transaction rate of 37%. The total starting price was ¥80.481m, and the total transaction price was ¥16.531m. Judicial auction this month is mainly of inland bulk carriers. In terms of commercial auctions, there were 14 ships auctioned, of which 9 ships were sold, with the transaction rate of 64.3%. The total starting price was ¥66.912m, the total transaction price was ¥143.527m, with a high premium rate.

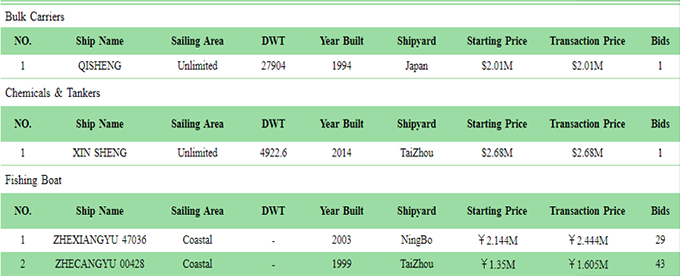

Followed were some specific auctions. In terms of bulk carriers, the Handysize bulk carriers QI SHENG was sold at a reserve price of $2.01m, while the auction of QI CHEN were failed for the third time. The four 10,000-ton-class coastal bulk carriers of "PUDAHAI", "PUFAHAI", "PUWANGHAI" and "PUXINGHAI" all traded at an undisclosed price. Oil tanker XIN SHENG of Togo flag was sold at $2.68m. In terms of other ships, the transaction of passenger ships were rare in August. There were 2 fishing vessels, and 3 engineering ships were traded, both slightly decreasing month-on-month.

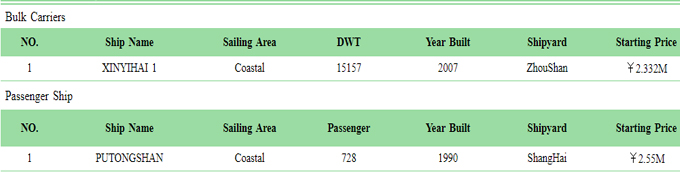

Samples of Ship Auctions

Preview of Ship Auctions