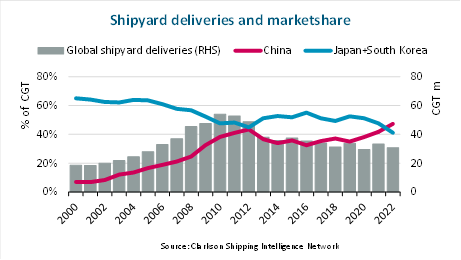

In 2022, Chinese shipbuilders reached a market share of 47% and for the first time exceeded the combined market share of Japanese and South Korean shipyards, according to new data released by BIMCO.

Shipyards in China also dominate the orderbook for ships to be delivered in the coming years. The global orderbook currently totals 109.1m cgt, and 45% of those orders are held by Chinese yards compared to 34% and 10% by South Korean and Japanese yards respectively.

Twenty years ago, Chinese shipyards had a market share of less than 10% but a massive capacity expansion during the 2000s propelled the country to the number one spot by 2009, a position the country has battled with South Korea over the ensuing years.

In the short-term, yards in other countries are unlikely competitors with China, South Korea and Japan likely to maintain their combined nearly 90% market share, according to Niels Rasmussen, chief shipping analyst at BIMCO.

“In search of lower costs, countries like Vietnam and the Philippines could become larger competitors in the future; similar to how the centre of shipbuilding historically moved from Europe to Japan and onwards to South Korea and China,” said Rasmussen.

The number of shipyards has contracted massively from the boom years of the first decade of the 21st century with the sector now far more risk-averse following many years of losses.

According to data from Clarksons Research, today’s shipbuilding capacity is around 40% lower than a decade ago. There are now only 131 large active yards, down from 321 at the peak of the previous shipyard boom in 2009. Clarksons Research’s monitoring of individual facilities suggests only moderate or marginal capacity increases in the medium term. The shipyard forward orderbook cover has edged up to 3.5 years from 2.5 years in 2020 and prices increased 5% across 2022 but were 15% higher on average in 2022 compared to 2021.

In the past few months, Splash has reported on the reopening of shuttered Chinese yards, STX Dalian and Rongsheng, as well as the reopening of Hyundai Heavy Industries’ shipyard in Gunsan in South Korea, while construction of a RMB20bn ($2.76bn) brand new yard has started in northeast China and will be completed by the end of 2024. The new yard, which will be run by Dalian Shipbuilding Industry (DSIC), will focus on LNG carrier construction.

Norwegian broker Fearnleys has also been examining the state of the yards. In a presentation given last month, Dag Kilen, Fearnleys’ global head of research, noted that among Asia’s shipbuilding powerhouses, Japan was the only nation with comparatively early delivery slots at the moment.

As the decade progresses, Kilen predicted a shipbuilding bottleneck will emerge, which will be a tailwind for all shipping sectors.

Not everyone is convinced about this potential yard crunch. Danish Ship Finance has argued that further consolidation is on the cards as up to 30% of today’s shipyards are on course to run out of orders soon.

“The lopsided nature of the ordering has created a situation where many of the yards that are not building container or LNG carriers are operating at low utilisation rates. Many are delivering vessels without securing new orders,” Danish Ship Finance pointed out in a recent report, going on to highlight how yard capacity is poorly utilised on average. A group of 95 first-tier yards utilised 70% of their capacity in 2022, according to data from Danish Ship Finance. A more numerous group of second-tier yards only utilised 40% of their capacity in 2022 and will use even less in 2023, Danish Ship Finance forecast, as well as predicting that global yard capacity could shrink by 9m cgt – or 18%- by year-end 2024 if yards that are running out of orders are closed the year after their last delivery.