Capesize rates have topped $30,000 per day, nearly doubling in May with many looking at the coming summer months in the northern hemisphere as a period where the sector could kick on to record some hefty profits as miners ramp output and countries rush to cover coal shortages.

Brokers report plenty of new cargoes hitting the Pacific today, with India in particular aggressive for coal deliveries. The Baltic Dry Index (BDI) is currently hitting its highest levels of the year to date, closing in on the 3,000 point mark, with capes finally catching up with their smaller dry bulk cousins in terms of spot earnings.

Moreover, a glance at June forward freight agreements, now trading at $39,000 a day, suggests capes have plenty of upside in the coming weeks.

“The Capesize market has finally showed signs of strength, with spot rates doubling over the past few weeks, catching up to what in hindsight was an accurate futures market versus one that at that time seemed way too optimistic,” stated a new report from New York-based Breakwave Advisors.

“Big pulls are now coming from both the West and the East, with Owners sending their ships away in all directions, confounding traditional fronthaul and backhaul patterns. Europe continues to drive coal imports from as far away as Australia, but India is taking up the competition, all the while as the market is seeing more requirements from China of iron ore coming out of Brazil. This is as exciting as it gets,” a recent report from Norwegian brokers Lorentzen & Co stated.

A sign of a heating up sector can be evidenced in the resale markets with Braemar ACM noting that the prompt resale price for a large capesize vessel in China increased by 10% month-on-month in April to $66m. Values have risen 20% year-on-year and the spread between the newbuild and prompt resale prices has reduced to $1m, a tightening in no small part down to the very limited cape newbuild berth availability at the moment on the back of record orders for LNG and container carriers over the past 18 months.

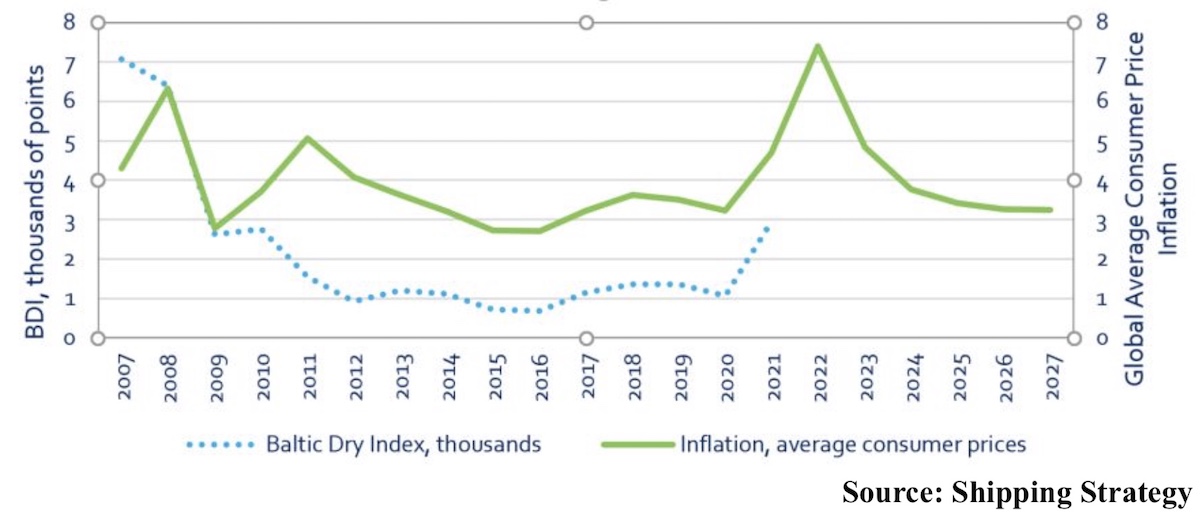

Also looking at the current firmness of the dry bulk markets while entering the traditionally stronger summer months in the northern hemisphere, Mark Williams, founder of British consultancy Shipping Strategy, noted the similarities between inflation and the BDI.

“I keep repeating to myself, ‘Correlation does not equal causation’ but then I keep looking at this chart of IMF inflation data and the Baltic Dry Index, then I think about seasonality in bulker markets, which typically means they rise from May to October,” Williams wrote in a social media post.